32+ single purpose reverse mortgage

Web There are three major types of reverse mortgage loans. Ad When Banks Say No We Say Yes.

Reverse Mortgage Loans For Regular Income Post Retirement Mymoneysage Blog

Get Started Now With Quicken Loans.

. Ad Compare the Best Reverse Mortgage Lenders. Ad Compare Mortgage Options Get Quotes. The home securing the reverse mortgage must be your primary residence.

Web There are several kinds of reverse mortgage loans. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. For Homeowners Age 61.

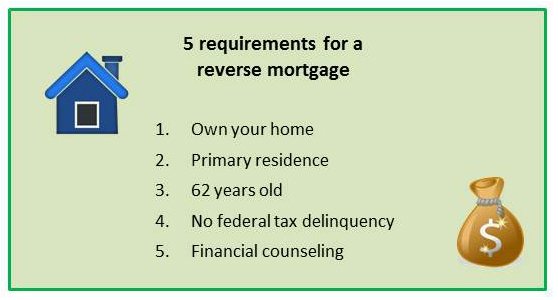

Web Single-purpose reverse mortgages. Web You and any other borrowers on the reverse mortgage must be at least 62 years of age. Compare a Reverse Mortgage with Traditional Home Equity Loans.

Web Single-purpose reverse mortgage qualifications In most cases homeowners must be 62 years or older and have low to moderate income to qualify for a single-purpose. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. Some state and local government agencies or nonprofits offer single-purpose reverse mortgages which are the least expensive reverse mortgage.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Home equity conversion mortgage proprietary reverse mortgage and single-purpose reverse mortgage. Web Single-purpose reverse mortgages are reverse mortgages designed to help lower-income seniors cover one specific lender-approved expense.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. 1 those insured by the Federal Housing Administration FHA. Web A reverse mortgage is designed for homeowners age 62 or older who want to tap into their home equity to pay for things like basic living expenses and healthcare costs.

We Are Not A Loan Company We Do Not Lend Money. Web A single-purpose reverse mortgage is an arrangement whereby lenders make payments to borrowers in exchange for some of the borrowers equity. Get Started Now With Quicken Loans.

2 proprietary reverse mortgage loans that are not FHA. Borrowers must use these. Ad Compare Mortgage Options Get Quotes.

What More Could You Need. They are offered by some. Free 1-On-1 Sessions w Mortgage Experts.

Web A single-purpose reverse mortgage allows homeowners that are 62 years of age or older to tap into their propertys equity to pay for expenses that are lender-approved. Web A reverse mortgage loan is a special type of mortgage loan for seniors generally age 62 and older. Get A Free Information Kit.

Web A single-purpose reverse mortgage is used for a one-time project or expense. Ad Educate Prepare Understand The Reverse Mortgage Process Find The Best Option For You. Unlike a traditional mortgage a reverse pays you loan proceeds drawn from your.

For Homeowners Age 61. Unlike the other two options it cant be used for ongoing expenses or to rebuild retirement assets. Founded in 1909 Mutual of Omaha Is A Financial Partner You Can Trust.

What More Could You Need.

Reverse Mortgages Who They Re For And The Pros And Cons

Reverse Mortgage Types Examples And Reviews Thestreet

2020 21 Twin Cities Senior Housing Guide By Senior Housing Guide Issuu

Broadview Home Loans Reverse Mortgage

Reverse Mortgage Spouse Eligible Vs Ineligible Protection

What Is A Single Purpose Reverse Mortgage Goodlife

What Is A Reverse Mortgage Reverse Mortgage Requirements

Reverse Mortgage What If The Spouse Is Not 62 Or Older

Nahb Report Optimistic About Reverse Mortgages

Synthesis Structure And Acid Base And Redox Properties Of A Family Of New Ru Ii Isomeric Complexes Containing The Trpy And The Dinucleating Hbpp Ligands Inorganic Chemistry

Helen Moore Mortgage Broker In Subiaco Mortgage Choice

Single Purpose Reverse Mortgages Explained Rocket Mortgage

Single Purpose Reverse Mortgage

Mike Meena Associates Home Loans Santa Clarita Ca

Reverse Mortgage Age Requirement When To Get A Reverse Mortgage Loan

Can Anyone Take Out A Reverse Mortgage Loan Consumer Financial Protection Bureau

:max_bytes(150000):strip_icc()/GettyImages-1355067067-40e29f8f76cd4daab40d00bad04c9288.jpg)

What Are Single Purpose Reverse Mortgages